- Home

- It's All About Community

- Chesapeake Bank Blog

- Address Verification Service Reduces Risk for Card-Not-Present Transactions

Address Verification Service Reduces Risk for Card-Not-Present Transactions

Chesapeake Payment Systems (CPS) offers an address verification service to prevent fraud for merchants accepting card-not-present transactions (online and over the phone).

When it comes to payments and security, our Merchant Technology Specialist, Joe Mayfield, says, “It’s best to implement a combination of security measures that cover these authentication points; something you know, something you are, and something you have.” Joe describes each point as:

- Something you know is information that you'll know about yourself, hopefully, better than others, like a passcode, a pattern, the correct responses to challenge questions, or other information that can be "verified."

- Something you are is biometrics. It's using your fingerprint, facial recognition, or other physical personal identification measures to gain access.

- Something you have is more tangible. It's a bit like calling home to get permission to use the system, and it's what's known as two-factor authentication. This is where the app, site, or service you're trying to access, will send a link or code to the contact information already on file for your account, hoping that you will be the recipient of the code, which you can then use to grant access.

Chesapeake Payment Systems Brings Another Layer of Security to Card Not Present Transactions:

While many of these practices are settings or information on the customer's end, our CPS team is always looking for ways to increase security and mitigate risks on our end - especially if it can help you, the business owner, manage your business more efficiently.

When it comes to card-not-present transactions, adding an address verification service (AVS) is one way e-commerce merchants as well as merchants accepting payments via phone can verify that cards are used by the actual customer, not a fraudster. It falls in the "something you know" category.

As for how it works, not much needs to be done by either customer or merchant.

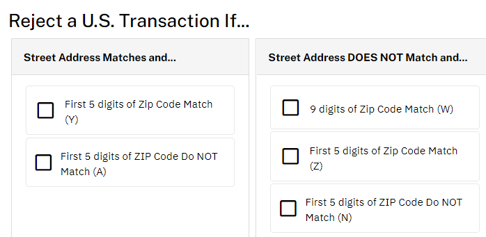

The merchant will be required to collect the address information during checkout. AVS will manually run a check through different systems during the authorization process and respond with different response codes. If the response code is in alignment with the merchant's conditions, the transaction will be approved. If the AVS check fails or generates a response code that the merchant/bank does not approve of, it will result in a failed transaction that is flagged.

The Benefits of Using the Address Verification Service:

- Implementing AVS provides an additional layer of security for both the merchant and the customer, which can help curb fraud from stolen card information.

- Additionally, AVS can prevent customers from submitting chargebacks that are levied against the merchant later on because it intercepts a transaction that might get disputed earlier in the process and declines it at the address verification level of the transaction.

- Trying to 'unpack' the process behind transaction fees is a bit too much for this article, but in theory, when it comes to card transactions, the more information that is collected during the transaction, the less processing fees you can end up paying as a merchant. You may not save a ton of money upfront, but the savings can accumulate to a sizable amount over time.

"AVS isn't a catch-all for fraud attempts, but just one of many tools that are available to merchants. Fraud is an ever-changing industry, and these tools will come, go, and adapt as needed," says Thanh Alexander, Merchant Technology Specialist, Chesapeake Payment Systems.

Address Verification isn't a catch-all for fraud attempts but just one of many available tools for merchants. Learn how our Chesapeake Payment Systems team can assist you with this service.

How Can You Sign Up?

Typically AVS is discussed with merchants during the boarding process if they choose to have card-not-present processing. But if you don't have it and would like more information, or if you'd like to know what other security measures are in place, contact our Chesapeake Payment Systems team at 757-941-1335 or help@chespay.com.

-

Categories

Posts by Topic

- Business (98)

- It's All About Community (73)

- Personal Finance (70)

- CFS News (49)

- Employees (46)

- Northern Neck (37)

- Middle Peninsula (34)

- Chesapeake Payment Systems (27)

- Richmond (26)

- Williamsburg (20)

- Fraud & Security (17)

- Home Buying (12)

- Chesapeake Wealth Management (11)

- Flexent (11)

- Customer Testimonials (7)

- COVID-19 (6)

- Chesterfield (5)