- Home

- It's All About Community

- Chesapeake Bank Blog

- Making Personal Finance Resolutions Easy

In order to save for a special goal, or improve your money habits, you first have to know how much you can spend, and to be able to identify where you are spending. Creating a budget and tracking expenses are the two best ways to get this information. The sooner you can identify and manage these areas the sooner you will be off to meeting your goals and financial freedom.

We’re thrilled to announce that our new online banking experience includes a number of tools to make habits like these and managing your finances easier.

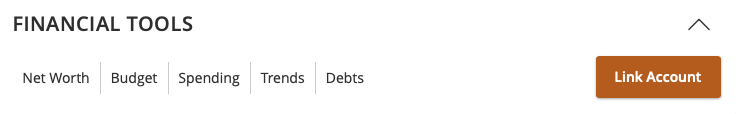

In this article we will only cover: Categorizing Transactions, Splitting Transactions, Spending, Trends, and building Budgets but our suite also allows you to Link Accounts, monitor your overall Net Worth, Cash Flow, and more.

You will need to first enable these Financial Tools in order to access them in the future.

FINANCIAL TOOLS

1. From the Dashboard (aka Home Screen)

2. At the top of the page, click the Get Started button beside Financial Tools

3. Click the Continue button under "Take Control of your finances…"

4. Accept the terms and then click the Continue button.

5. If you go back to the dashboard and you will see an expanded toolbar that now shows the following options: Net Worth, Budget, Spending, Trends, and Debts.

6. When you look at your transactions, you will now also see the option to categorize them. Let’s start there.

CATEGORIZING TRANSACTIONS

You’ll want to separate each of your transactions into different groups to see how much you are spending in each area. If the thought of this overwhelms you, relax. Our intelligent system categorizes most of your transactions for you already, which you can edit and override if needed. The system will also learn from your edits to save you time in the future.

1. From the Dashboard page, select an account.

2. On the Account Details page, find a transaction you'd like to categorize

3. Select the category icon next to that transaction. (It will be a colored circle with an image.)

4. When the list of categories appears, expand the parent category by clicking on the down arrow to reveal subcategories.

5. You may also select +Add Subcategory

a. Enter the name of the new Subcategory.

6. When you select the Subcategory, a green checkmark will appear on that listing.

The transaction icon will also change, and the subheading beneath each transaction will show the category name.

7. All transactions for that place of business will update to the new category.

Note: For checks, when you click on the transaction, a detail window will expand. Please give it a few minutes, and an image of your check will populate this window.

SPLITTING TRANSACTION CATEGORIES

Splitting transactions will allow you to apply up to nine categories to a transaction to help you get to the closest dollar to each category in your budget.

1. On the Home page, select an account.

2. Locate a transaction that you would like to split

3. On the transaction, select the three dots on the right and select Split transaction.

4. On the Splits tab, enter the amount you want to split into a separate category.

5. Select the checkmark to accept.

6. Select the category icon and select a new category for the amount you want to split.

7. Select +Split Transaction to add another category.

Note: After you split a transaction, you can no longer edit the category from the transaction details. You cannot edit the description of an individual split.

BUDGETS

Now that you've categorized all of your transactions, it's time to make your budget.

1. From the dashboard, browse to the section labeled Financial Tools.

2. Click the link that says Budget

3. From this screen, you can choose between Start from Scratch to build your own Budget or select Auto Generate Budgets.

Within each budget type, you will have an option to edit the amount of money for each category to match your targets. You can also refer to our online help tool for additional step by step instructions to help you manage the budget you choose. Make sure to select the MX Budget option.

The Spending tab and Trends tab will also provide you with different snapshots of your account. The best part is that because these tools are all in the same place, they will all instantly reflect your changes as you make adjustments.

FOR ADDITIONAL HELP

All of our financial tools have step by step instructions available on our help site. We also offer a training program, a selection of calculators for your financial needs, and if you have a question, we have a team that can help. Just call or text your favorite branch.

DON'T FORGET

One of the most important parts of getting ahead of your finances is checking in frequently, making note of your progress and making adjustments as needed. Regular practice and being mindful of spending habits will help you stick within your spending limits.

-

Categories

Posts by Topic

- Business (98)

- It's All About Community (73)

- Personal Finance (70)

- CFS News (49)

- Employees (46)

- Northern Neck (37)

- Middle Peninsula (34)

- Chesapeake Payment Systems (27)

- Richmond (26)

- Williamsburg (20)

- Fraud & Security (17)

- Home Buying (12)

- Chesapeake Wealth Management (11)

- Flexent (11)

- Customer Testimonials (7)

- COVID-19 (6)

- Chesterfield (5)